Executive Summary

Organizations deploying AI systems face a critical compliance question: Are the prompts users submit to AI tools official records requiring retention under regulatory frameworks?

This article presents two formal logical proofs—one using symbolic logic, another using deontic logic—demonstrating that AI prompts cannot be classified as official records. The mathematical certainty of these proofs provides compliance professionals with a defensible position that eliminates interpretive ambiguity. The practical implications are significant: organizations can exclude prompts from retention schedules, reduce storage costs, and focus compliance efforts on actual records. Unlike opinion-based guidance, formal logic offers legal certainty that withstands regulatory scrutiny and litigation discovery.

By understanding these proofs, compliance professionals gain both immediate practical guidance and a powerful analytical tool for resolving future classification challenges in our increasingly AI-driven business environment.

Introduction: The Compliance Challenge

The explosive adoption of AI tools across enterprises has created an urgent compliance question that keeps information governance professionals awake at night: When employees interact with AI systems, do their prompts constitute official records?

The answer carries serious consequences. Misclassification as records triggers retention obligations, litigation hold requirements, and audit trails that could cost millions in unnecessary storage and management overhead. Conversely, failing to preserve actual records risks regulatory sanctions, legal spoliation claims, and reputational damage.

Traditional approaches to this question rely on subjective interpretation of regulatory language, leading to inconsistent policies across organizations and industries. Some companies defensively preserve everything, creating massive data lakes of questionable value. Others delete prompts immediately, hoping their interpretation holds up under scrutiny. Neither approach provides the certainty compliance professionals need.

This article introduces a novel solution: using mathematical logic to achieve regulatory certainty. Formal logic transforms ambiguous regulatory language into precise logical statements that yield definitive answers. Just as engineers use mathematics to prove a bridge will stand, we can use logic to prove prompts are not records—a proof that stands up in boardrooms, courtrooms, and regulatory proceedings.

By the end of this article, you will understand both the logical proofs and their practical applications. More importantly, you'll possess a new tool for analyzing complex compliance questions with mathematical precision, moving beyond opinion to achieve genuine regulatory certainty.

Regulatory language, despite legislators' best efforts, often contains inherent ambiguities that create compliance uncertainty. Terms like "business record," "official documentation," and "evidence of transaction" seem clear until you try applying them to edge cases like AI prompts. Different stakeholders interpret the same regulation differently, leading to inconsistent practices and compliance risk.

Formal logic eliminates this interpretive ambiguity by translating regulatory requirements into mathematical statements with definitive truth values. Consider a simple example: "All documents with signatures are contracts." In formal logic, this becomes a precise rule that either applies or doesn't—no interpretation needed. If a document has a signature, it's a contract. If it lacks a signature, the rule doesn't apply. The clarity is absolute.

Legal systems increasingly recognize formal logic as a valid interpretive tool. Courts routinely apply logical analysis to statutory interpretation, particularly in complex regulatory contexts. The Supreme Court has referenced logical principles in numerous decisions, establishing precedent for logic-based regulatory analysis. Administrative agencies accept logical arguments in rulemaking comments and enforcement proceedings.

During audits or litigation, a position based on formal logic provides exceptional defensibility. Rather than arguing interpretation, you demonstrate mathematical proof. Opposing counsel cannot simply disagree with mathematics. Regulators must either accept the logical conclusion or explicitly contradict established logical principles—a difficult position to defend. This transforms compliance from subjective interpretation to objective analysis, replacing uncertainty with mathematical certainty.

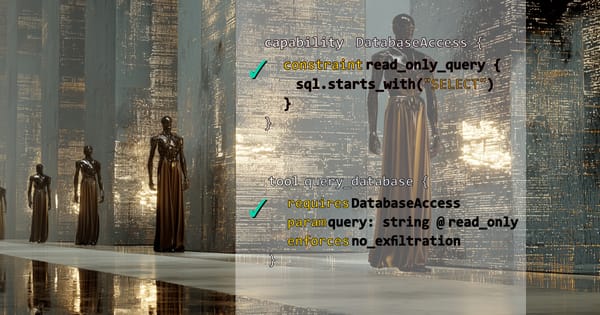

Symbolic Logic Primer for Compliance Professionals

Think of symbolic logic as a precise language for expressing rules—like switching from conversational English to the exact language of a legal contract. Just as contracts define terms precisely to avoid ambiguity, symbolic logic uses symbols to express relationships with mathematical certainty.

Variables (x, y, z) function like placeholders in a form template. When you create a contract template with fields for [PARTY_NAME] and [EFFECTIVE_DATE], you're using variables. In logic, 'x' might represent "any document" or "any prompt," allowing us to make statements about entire categories.

Predicates like R(x) work like checkboxes on a compliance form—either true or false. R(x) might mean "x is a record." For any specific document, R(x) is either true (it is a record) or false (it isn't). No ambiguity exists.

The universal quantifier ∀ means "for ALL items in a category." When regulations state "all financial transactions must be recorded," they're making a universal statement: ∀x (Financial_Transaction(x) → Must_Record(x)).

The existential quantifier ∃ means "at least ONE item exists." Statements like "some documents require special handling" translate to: ∃x (Document(x) ∧ Requires_Special_Handling(x)).

Logical operators connect statements:

- AND (∧): Both conditions must be true. "Records must be authentic AND reliable" means both requirements apply.

- OR (∨): At least one condition must be true. "Documents are discoverable if they're records OR contain evidence" means either condition triggers discoverability.

- NOT (¬): The opposite is true. "Not a record" is written ¬R(x).

- IMPLIES (→): If-then relationships. "If it's a contract, then it requires retention" becomes Contract(x) → Requires_Retention(x).

Consider this business rule: "All contracts require signatures and dates." In symbolic form: ∀x (Contract(x) → (Signature(x) ∧ Date(x))) This reads: "For all x, if x is a contract, then x has a signature and x has a date."

The First Proof:

Symbolic Logic Analysis

Setup Phase

Let's define our predicates in plain English to establish a clear foundation:

- P(x): x is an AI prompt

- R(x): x is an official record

- F(x): x is finalized and immutable

- T(x): x represents a completed transaction

- E(x): x provides evidence of business activity

- A(x): x has been formally accepted into a system

- M(x): x is modifiable

Official records, according to NARA guidance, ISO 15489, and DoD 5015.2-STD, must possess five essential properties:

- Authenticity: The record is what it purports to be

- Reliability: The record accurately represents the transaction

- Integrity: The record remains unaltered after creation

- Usability: The record can be located and interpreted

- Completeness: The record represents a finished business transaction

These translate into logical axioms:

- Axiom 1: ∀x (R(x) → F(x)) — All records must be finalized

- Axiom 2: ∀x (R(x) → T(x)) — All records represent completed transactions

- Axiom 3: ∀x (P(x) → M(x)) — All prompts are modifiable until submission

- Axiom 4: ∀x (P(x) → ¬A(x)) — Prompts are not formally accepted until processed

- Axiom 5: ∀x (M(x) → ¬F(x)) — Modifiable items cannot be finalized

The Proof Walkthrough

Step 1: Assume a prompt could be an official record: ∃x (P(x) ∧ R(x))

Translation: "Let's suppose there exists something that is both an AI prompt and an official record."

Real example: Like claiming a draft email you're still composing is already an official record.

Why it matters: We'll demonstrate this assumption creates a logical impossibility.

Step 2: If our assumption holds, then by Axiom 1: R(x) → F(x)

Translation: "This prompt-record must be finalized and immutable."

Real example: Like saying the contract is signed and legally binding.

Why it matters: Records require immutability for legal validity.

Step 3: But by Axiom 3: P(x) → M(x)

Translation: "Being a prompt means it's still modifiable."

Real example: Users can edit prompts before submission, just like editing a search query.

Why it matters: The essential nature of prompts includes modifiability.

Step 4: By Axiom 5: M(x) → ¬F(x)

Translation: "If something is modifiable, it cannot be finalized."

Real example: You can't have a "final draft"—it's either final or a draft.

Why it matters: This creates our contradiction.

The Contradiction Revealed

We've proven that our hypothetical prompt-record must be both finalized (because it's a record) and not finalized (because it's modifiable). This is logically impossible—like claiming water is simultaneously frozen solid and actively boiling. The assumption that prompts can be records creates a logical contradiction, proving that prompts cannot be official records.

This isn't opinion or interpretation. It's mathematical proof. No amount of regulatory guidance can make something both finalized and not finalized simultaneously.

Deontic Logic:

The Compliance Obligation Framework

Introduction to Deontic Logic

While symbolic logic tells us what IS, deontic logic tells us what MUST BE—the perfect tool for analyzing compliance obligations. Deontic logic specifically handles obligations, permissions, and prohibitions, the three pillars of regulatory compliance.

Every regulation creates obligations ("shall maintain records"), permissions ("may request extensions"), or prohibitions ("shall not destroy evidence"). Deontic logic provides a mathematical framework for analyzing whether these obligations conflict or create impossible requirements. This matters because contradictory obligations render compliance impossible, providing a complete defense against enforcement action.

In the context of AI prompts, we'll demonstrate that classifying them as records creates irreconcilable conflicts between regulatory obligations and system permissions.

Deontic Operators in Plain English

- O(φ): "You MUST do this" — like SEC requirements to file 10-K reports annually

- P(φ): "You MAY do this" — like voluntary sustainability disclosures

- F(φ): "You MUST NOT do this" — like destroying documents under litigation hold

These operators follow logical rules. If something is obligatory, it must be permissible: O(φ) → P(φ). If something is forbidden, it cannot be obligatory: F(φ) → ¬O(φ).

The Second Proof Walkthrough

Step 1: Records carry specific obligations under regulatory frameworks.

Deontic rule: O(immutable(x)) if R(x)

Compliance translation: "Official records MUST remain unaltered after creation."

Practical implication: Once designated a record, the content cannot change.

Step 2: AI systems grant users permission to modify prompts.

Deontic rule: P(modify(x)) if P(x)

Compliance translation: "Users MAY edit prompts before submission."

Practical implication: The system explicitly allows prompt modification.

Step 3: These create incompatible obligations.

Deontic rule: O(¬modify(x)) ∧ P(modify(x))

Compliance translation: "You MUST NOT modify this, but you MAY modify this."

Practical implication: The system simultaneously forbids and permits the same action—a logical impossibility.

Step 4: When obligations conflict, the classification creating the conflict must be invalid.

Deontic principle: Ought implies can

Compliance translation: "You cannot be obligated to do the impossible."

Practical implication: Since prompts cannot satisfy record obligations, they cannot be records.

Practical Implications for Your Compliance Program

What This Means for Your Organization

Prompts need not be included in retention schedules. Your records retention schedule can explicitly exclude AI prompts as transitory inputs that don't constitute official records. This simplifies schedule management and reduces storage requirements.

No obligation to preserve prompts during legal holds. When litigation hold notices arrive, you need not preserve the millions of prompts users generate. Focus preservation efforts on actual AI outputs and decisions based on those outputs.

Prompts can be excluded from records inventories. Your annual records inventory need not account for prompt volumes, simplifying reporting and reducing administrative burden.

User training should distinguish prompts from actual records. Train employees that their AI interactions become records only after processing and formal acceptance into business systems.

When Prompts Become Records

The transformation from non-record prompt to official record occurs at specific moments:

- After submission and system processing: Once the AI processes a prompt and generates output that's formally captured

- When incorporated into official communications: If prompt text appears in emails, reports, or formal documents

- When used as evidence of decision-making: If prompts are specifically preserved to document business reasoning

- Key principle: The OUTPUT may be a record, the INPUT is not

Implementation Recommendations

Update your information governance policies with explicit language: "AI prompts, prior to processing and formal system acceptance, are not official records and are not subject to retention requirements."

Clarify in AI usage guidelines that employees should capture important AI outputs but need not preserve their prompts. Include examples distinguishing prompts from records.

Train records managers on the logical basis for this distinction. Provide them with this article's proofs to support their classification decisions.

Document your logical basis for classification decisions in your records management manual. Include the formal proofs as appendices to demonstrate the rigor of your analysis.

Addressing Common Objections

"But everything electronic might be discoverable"

Discovery obligations differ from records management requirements. Discoverability depends on relevance to litigation, not records classification. Courts may request prompt data in specific cases, but this doesn't make all prompts records requiring retention. Implement reasonable data lifecycle management that balances discovery obligations with data minimization principles.

"What if regulators disagree?"

Formal logic provides an exceptionally defensible position. Regulators must either accept logical conclusions or explicitly state that regulations require logical impossibilities. Administrative law principles prevent agencies from enforcing impossible requirements. The burden shifts to regulators to explain how something can be simultaneously mutable and immutable. Document your logical analysis to demonstrate good faith compliance efforts.

"Shouldn't we keep everything to be safe?"

Over-retention creates its own risks. Privacy regulations like GDPR and CCPA require data minimization—keeping only what's necessary. Excessive retention increases breach exposure, discovery costs, and storage expenses. Prompts may contain sensitive information users didn't intend to preserve permanently. Focus retention on actual business records with defined value.

Our symbolic logic proof demonstrated that prompts cannot satisfy the essential properties of official records—they cannot be simultaneously modifiable (as prompts must be) and immutable (as records must be). Our deontic logic proof revealed that classifying prompts as records creates impossible compliance obligations—systems cannot simultaneously permit and forbid modification.

These proofs provide compliance professionals with mathematical certainty that prompts are not official records. This certainty translates into clear policies, reduced compliance burden, and defensible positions during audits. Organizations can confidently exclude prompts from retention schedules while focusing governance efforts on actual records.

Beyond this specific question, formal logic offers a powerful tool for analyzing complex compliance challenges. As AI systems grow more sophisticated and regulations struggle to keep pace, the ability to apply logical analysis becomes increasingly valuable. Compliance professionals who master these techniques gain competitive advantage in navigating regulatory uncertainty.

The future of compliance lies not in accumulating ever-more data "just in case," but in applying rigorous analysis to determine what truly requires governance. Formal logic provides the framework for making these determinations with confidence, transforming compliance from reactive interpretation to proactive certainty.